Doing Business

Jump to a Section:

Starting a business can be complicated. We want to help provide the resources you need to navigate the rules and regulations that are found in Franklin County. It is our goal to make this process as simple and painless as possible.

If you need assistance from one of our staff members please don’t hesitate to reach out to our office at (502) 875-8751.

Good luck in your new venture!

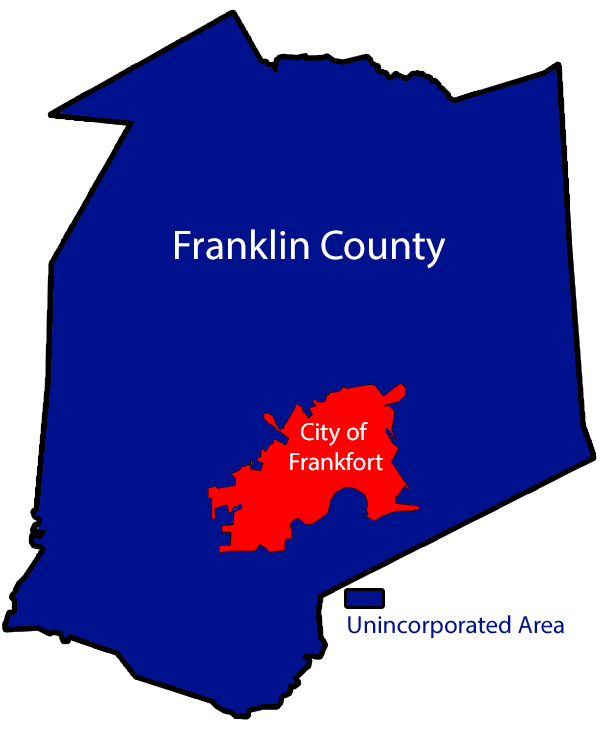

Our Jurisdictional Area

We serve the businessesin the unicorporated areas of Franklin County outside of the City of Frankfort.

Business Licenses

F.A.Q.’s

Who Should Obtain a Business License?

Any person, association, corporation, or other entity engaged in any trade, occupation, or profession or other activity performed in Franklin County, outside the incorporated area. This includes all contractors and subcontractors.

How Do I Apply For a License?

In Franklin County-For those operating in an office or commercial setting, a business license application must be completed and submitted with the $40.00 application fee. You can find the business license application on our Tax Administration page.

What about my Franklin County Home Office?

For those operating a business based from a home that is located in the county, a business license application as well as a home office questionnaire must be completed and submitted with the $40.00 application fee.

What about Out of Town or City of Frankfort Residents?

For those residents whose home or business is located in the city but performs work in the county, a business license application must be completed and submitted with a $40.00 application fee.

What about Non Profit Organizations?

Non Profit Organizations who have employees must complete a business license application and home office questionnaire (if applicable). In order to register for a Franklin County withholding account. However, they are exempt from the application fee, will not be issued a license, and are exempt from Net Profits License Fee Tax.

What about Renewing my License?

Net Profit Returns

The Net Profits License Fee tax rate is 1%. This tax is levied and imposed on the earnings of a person, association, corporation or other entity engaged in any occupation, trade, profession or other activity conducted or performed in the unincorporated area of Franklin County.

Filing the Net Profit License Fee Return renews your business license each year.

Minimum Fee – Please note that there is a minimum fee of $40.00 associated with the Net Profits License Fee Return. The taxpayer should pay the greater of $40.00 or 1% of the net profits earned from activity within the unincorporated area of Franklin County.

Due Date-The Net Profit License Fee Return is due 105 days after the end of your tax year. For example, if you operate on a calendar year, the return is due by April 15 of each year.

Federal Return-A copy of the federal return for your business must accompany your county Net Profit Return.

Who do I contact for more information?

Summer Lovern,

Occupational Tax Administrator

Phone (502) 875-8709

Fax (502) 875-8737

Email: summer.lovern@franklincounty.ky.gov

Taxes

Occupational Tax

Payroll Withholding Tax

The Occupational Withholding tax rate is 1%. This tax is on all wages and compensation for work done or services performed in the unincorporated area of Franklin County by every resident and non-resident who is an employee. Employers are required to withhold occupational tax from their employees and submit the tax to the Franklin County Occupational Tax Office on a quarterly basis. Occupational tax is due 30 days after the end of each quarter.

Penalties

Failure to apply for a license or to file any of the above referenced returns will result in penalties, interests and fines. Additionally, delinquent taxes may be turned over to the County Attorney for collection, and a court order may be obtained prohibiting the further conduct of the business.

Transient Room Taxes

Pursuant to KRS 91A.390 this tax is for the purpose of financing the Tourist/Convention Commission

3% of gross rents for every room occupancy of accommodation businesses in Franklin County (outside of the Frankfort city limits)

Pursuant to KRS 91A.392

For the purpose of financing a fine arts center

2% of gross rents for every room occupancy of accommodation businesses in Franklin County (includes businesses within the City of Frankfort)

Need more information about Business Licenses or Taxes?

Be Sure to check out our Tax Administration Page for more in-depth information!

Planning & Zoning Information

Questions about Signage?

Ben Judah

Planning Supervisor

bjudah@franklincountyky.com

(502) 875-8701 Phone

(502) 875-8737 Fax

Franklin County Mapping Portal

Click to access our zoning map, city & county boundaries and more!

Franklin County Planning & Zoning Page

Click For more infomtion about Planning, Zoning and Code Enforcement.

Acoholic Beverage Licensing

Jack Kennedy

Deputy ABC Administrator

jack.kennedy@franklincounty.ky.gov

(502) 875-8751 Phone

(502) 875-8755 Fax

Franklin County ABC Page

Click For more infomtion about Acoholic Beverage Licensing