Tax Administration

Occupational Tax Administrator Summer Lovern reviews an excel spreadsheet with County Treasurer Amy Quatman.

Tax Administrator

Summer Lovern

summer.lovern@franklincounty.ky.gov

The Franklin County Occupational Tax Office is the collection agent on behalf of Franklin County Fiscal Court. The Occupational Tax Office also issues business licenses and collects the transient room tax and insurance premium tax on behalf of Franklin County Government. All persons/businesses working in the Franklin County area should be licensed through this office.

Fax: (502) 875-8737

Phone: (502) 875-8709

Monday-Friday

8 AM – 4:30 PM

321 West Main Street

Frankfort, Kentucky, 40601

Occupational License Requirements

Any individual, partnership, corporation, or other legal entity doing business in Franklin County (outside the city limits), is required to open and maintain a county business license. There is a $40.00 initial processing fee (non-refundable).

Each person shall be required to complete a separate questionnaire for each separate business before the commencement of business or in the event of a status change, other than

License Fees

Occupational License Fee

An Occupational License Fee is imposed on the wages of those employees working in Franklin County at the rate of 1% of all salaries, wages, commissions and other compensation including deferred compensation, earned for work and or services performed in the county.

Net Profit License Fee

An Annual Net Profit License Fee is levied on all persons, fiduciaries, corporations, and associations engaged in the occupation, trade, profession or other business earned for work performed in the county at the rate of 1%.

The Net Profit License Fee is assessed equally on both residents and non-residents performing work in the city.

Occupational License Fee

For an employee, the employer must withhold the occupational license fee from any payment made for services performed or work done in the county. The employer is responsible to remit the employee withholdings to the county on a quarterly filing basis.

Net Profit License Fee

Each entity conducting business in Franklin County (outside the city limits) must make an application for an occupational business license before commencement of activity and pay the initial forty ($40.00) minimum license fee. Issuance of the occupational business license requires the licensee to file the annual Net Profit License Fee return for each year or part of year business activity takes place in Franklin County (outside of city limits). The Net Profits License Fee return is due April 15 of each year, except returns made on the basis of a fiscal year, which shall be made by the fifteenth day of the fourth month following the close of the fiscal year.

Request for Net Profit Extension

If an extension is necessary, a written request and copy of State or Federal application for extension must be submitted to the Franklin County Occupational Tax office before the due date of the Net Profits License Fee Return. If extension is granted, enter dated on Line 14. Interest remains due from original due date (See Line 13).

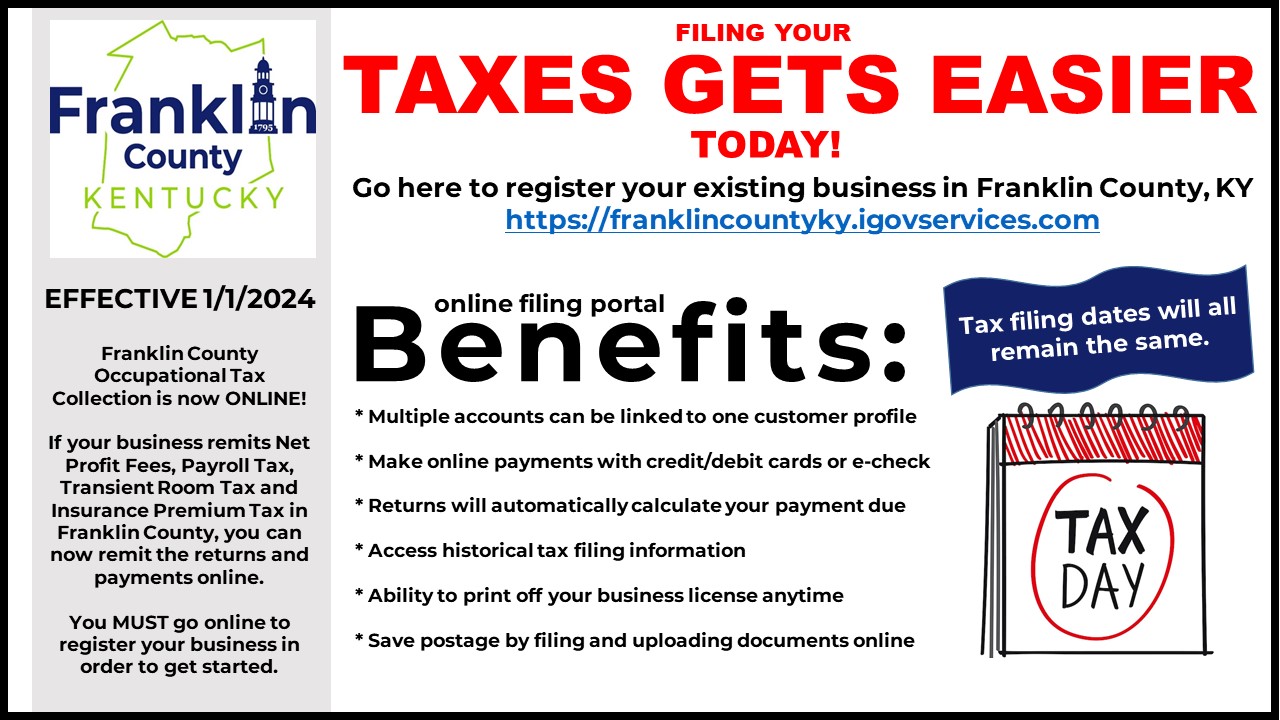

Announcements, Informational Resources & Documents

The County occupational tax rate will remain at the current rate of 1% for 2018, for both payroll and net profits.

Occupational Tax Forms

1st – 3rd Quarter Payroll Return

4th Quarter Payroll Return

(includes Annual Reconciliation)

Net Profits License Fee Return Instructions

Net Profits License Fee Return

——–

Quarterly Insurance Premium Return Instructions

Quarterly Insurance Premium Tax Return

Request for Net Profit Extension

Transient Room Taxes

Pursuant to KRS 91A.390

For the purpose of financing the Tourist/Convention Commission

3% of gross rents for every room occupancy of accommodation businesses in Franklin County (outside of the Frankfort city limits)

Pursuant to KRS 91A.392

For the purpose of financing a fine arts center

2% of gross rents for every room occupancy of accommodation businesses in Franklin County (includes businesses within the City of Frankfort)

FINE ARTS CENTER TRANSIENT ROOM TAX RETURN