Tax Administration

The Franklin County Occupational Tax Office is the collection agent on behalf of Franklin County Fiscal Court. The Occupational Tax Office also issues business licenses and collects the transient room tax and insurance premium tax on behalf of Franklin County Government. All persons/businesses working in the Franklin County area should be licensed through this office.

Fax: (502) 875-8737

Phone: (502) 875-8709

Monday-Friday

8 AM – 4:30 PM

321 West Main Street

Frankfort, Kentucky, 40601

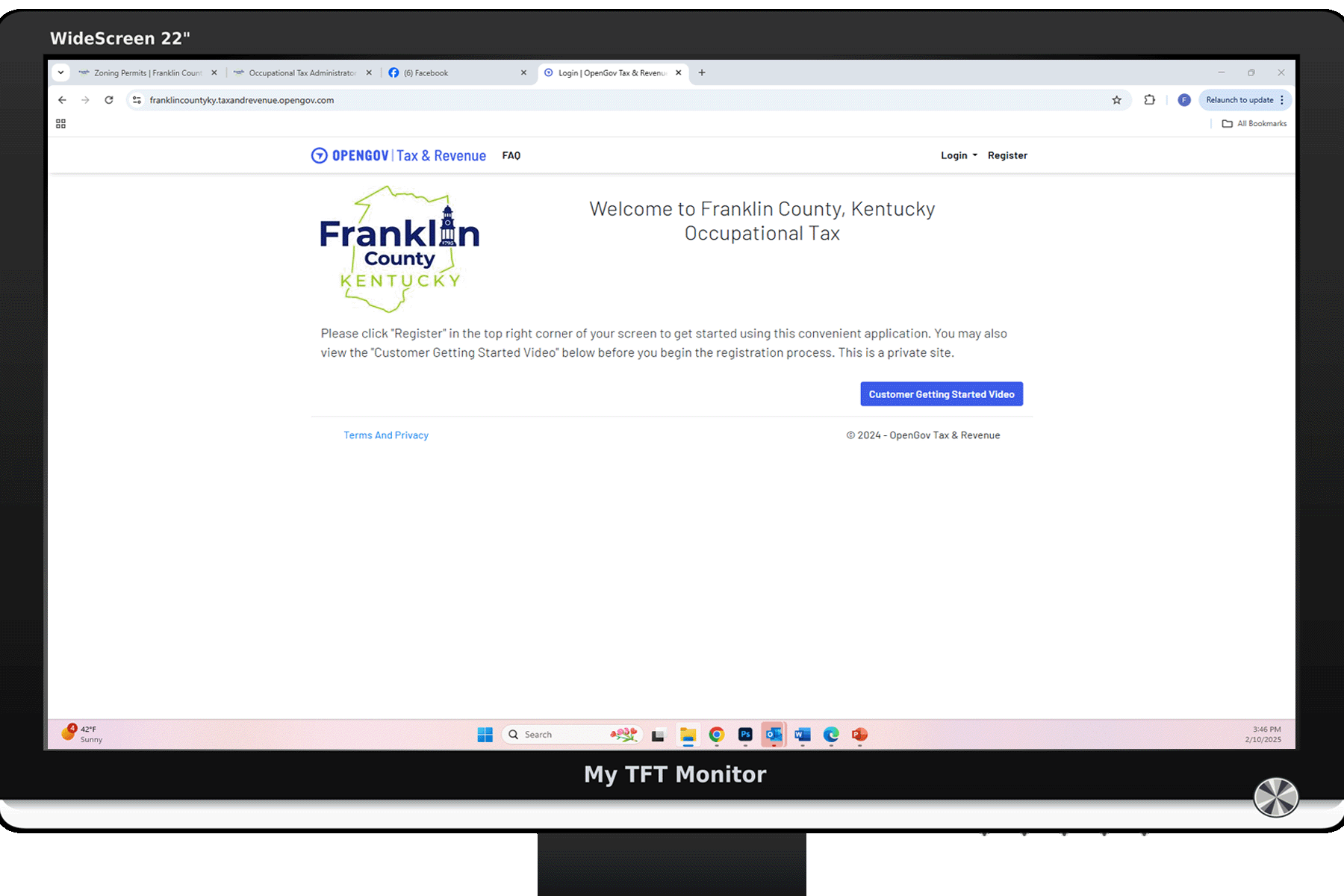

Tax Payment Portal

Click this link to access our online tax payment portal. You MUST first register your business in order to get started.

FILING YOUR TAXES HAS GOTTEN EASIER!

You can now remit your Franklin County net profit, transient room taxes, and insurance premium taxes online! The process is easy and simple.

Benefits to signing up for our online filing portal

- Multiple accounts can be linked to one customer account

Make online payments with credit/debit cards or e-check - Returns will automatically calculate your payment due

- Access historical tax filing information

- Ability to print off your business license anytime

- Save postage by filing and uploading documents online

Occupational Tax Frequently Asked Questions

Occupational License Requirements

Any individual, partnership, corporation, or other legal entity doing business in Franklin County (outside the city limits), is required to open and maintain a county business license. There is a $40.00 initial processing fee (non-refundable).

Each person shall be required to complete a separate questionnaire for each separate business before the commencement of business or in the event of a status change, other than

Occupational License Fee

An Occupational License Fee is imposed on the wages of those employees working in Franklin County at the rate of 1% of all salaries, wages, commissions and other compensation including deferred compensation, earned for work and or services performed in the county.

For an employee, the employer must withhold the occupational license fee from any payment made for services performed or work done in the county. The employer is responsible to remit the employee withholdings to the county on a quarterly filing basis.

Net Profit License Fee

An Annual Net Profit License Fee is levied on all persons, fiduciaries, corporations, and associations engaged in the occupation, trade, profession or other business earned for work performed in the county at the rate of 1%.

The Net Profit License Fee is assessed equally on both residents and non-residents performing work in the city.

Each entity conducting business in Franklin County (outside the city limits) must make an application for an occupational business license before commencement of activity and pay the initial forty ($40.00) minimum license fee. Issuance of the occupational business license requires the licensee to file the annual Net Profit License Fee return for each year or part of year business activity takes place in Franklin County (outside of city limits). The Net Profits License Fee return is due April 15 of each year, except returns made on the basis of a fiscal year, which shall be made by the fifteenth day of the fourth month following the close of the fiscal year.

Request for Net Profit Extension

If an extension is necessary, a written request and copy of State or Federal application for extension must be submitted to the Franklin County Occupational Tax office before the due date of the Net Profits License Fee Return. If extension is granted, enter dated on Line 14. Interest remains due from original due date (See Line 13).

Transient Room Taxes

PRIOR TO 7/1/2025

Pursuant to KRS 91A.390

For the purpose of financing the Tourist/Convention Commission

3% of gross rents for every room occupancy of accommodation businesses in Franklin County (outside of the Frankfort city limits)

Pursuant to KRS 91A.392

For the purpose of financing a fine arts center

2% of gross rents for every room occupancy of accommodation businesses in Franklin County (includes businesses within the City of Frankfort)

EFFECTIVE 7/1/2025

Pursuant to KRS 91A.390

For the purpose of the Sports Tourism Commission

3% of gross rents for every room occupancy of accommodation businesses in Franklin County (includes businesses within the City of Frankfort)

For the purpose of a convention center

1% of gross rents for every room occupancy of accommodation businesses in Franklin County (includes businesses within the City of Frankfort)

Pursuant to KRS 91A.392

For the purpose of the Fine Arts Center

2% of gross rents for every room occupancy of accommodation businesses in Franklin County (includes businesses within the City of Frankfort)